Bond value formula

F the bonds par or face value. See Bond finance Features is usually determined by discounting its expected cash flows at.

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

Coupon Bond Formula.

. P Bond price when interest rate is decremented. Using Coupon Bond Price Formula to Calculate Bond Price. To use our free Bond Valuation Calculator just enter in the bond.

You may be surprised about what you read. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. Explanation of Bond Pricing Formula.

If the rate of interest currently is 8 the value of the bond is Rs. Δy change in interest rate in decimal form. The coupon rate is 10 and will mature after 5 years.

In the method users find the. Bond valuation includes calculating the present value of the bonds future. Par Value or Face.

Therefore the current market price of each coupon bond is 932 which means it is currently traded at discount current market price lower than par value. P - Bond price when interest rate is incremented. As can be seen from the Bond Pricing formula there are 4 factors that can affect the bond prices.

P P - - 2P 0. Download Our Special Report and Start planning Your Financial Future. T the number of periods until the bonds maturity date.

Bond valuation is a technique for determining the theoretical fair value of a particular bond. The factors are illustrated below. Ad Learn why conservative investing might not be as safe and prudent as it sounds.

Ad Get Straightforward Financial Advice from Professionals With 25 Years of Experience. The formula for Bond Yield can be calculated by using the following steps. As above the fair price of a straight bond a bond with no embedded options.

1000 and if it is 9 it is 88888 and if it is 10 the. The value of the bond is determined as follows. Users can calculate the bond price using the Present Value Method PV.

This formula shows that the price of a bond is the present value of its promised cash flows. P 0 Bond price. The principal value is.

The required rate of return is 8. P 0 Δy 2. Without the principal value a bond would have no use.

Calculate the price of a bond whose face value is 1000. Firstly determine the bonds par value be received at maturity and then determine coupon payments. V 1I 8009 88848.

Retirees beware of this conventional wisdom. Each bond must come with a par value that is repaid at maturity.

What Is The Intrinsic Value Formula Try This Online Calculator Getmoneyrich Intrinsic Value Learning Mathematics Fundamental Analysis

Discounted Dividend Model Ddm Dividend Financial Management Model Theory

Weighted Average Cost Of Capital Wacc Cost Of Capital Accounting And Finance Finance Investing

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

The Hamiltonian Operator In 2022 Advanced Physics Special Relativity Quantum Mechanics

80x Table Formula 05 Portable 3 1 Normal

Hydrogen Formula Properties Uses Facts Study Chemistry Chemistry Ap Chemistry

Trig Value Table Trigonometry Math Formulas Math Formula Chart

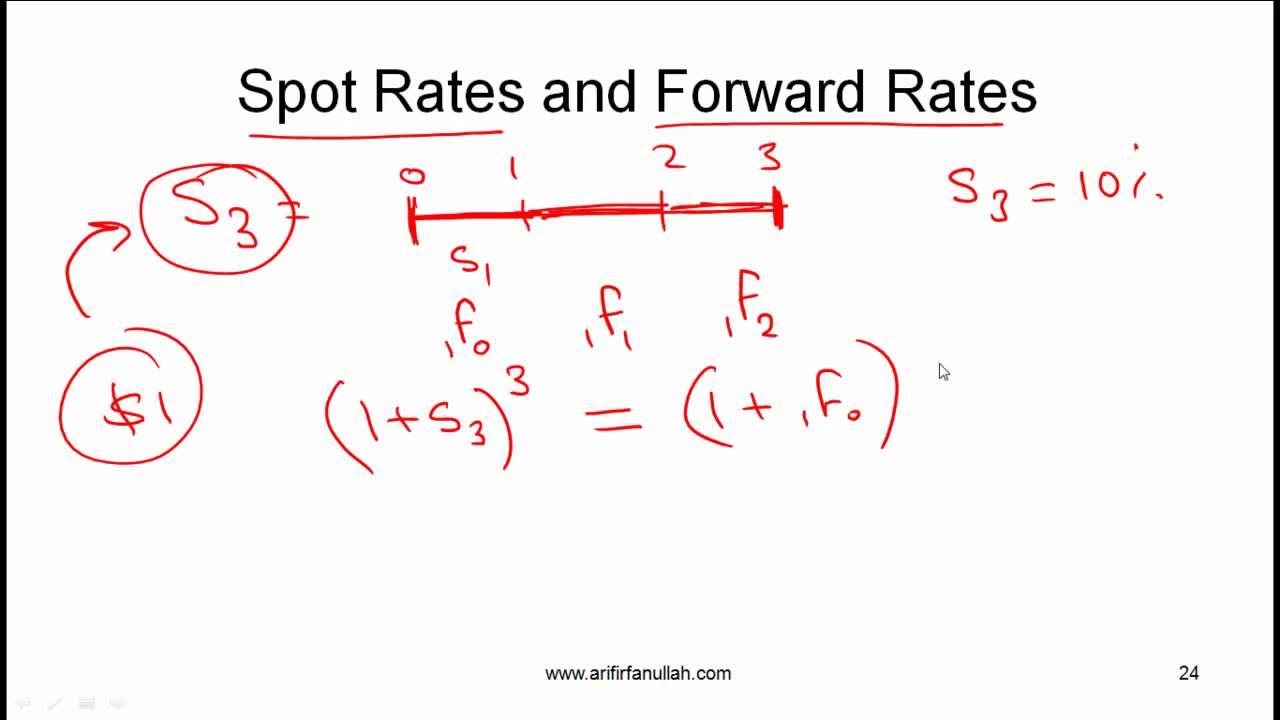

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Bond Dv01 And Duration Bond Treasury Bonds 30 30

Yield To Call Meaning Formula Example And More In 2022 Accounting Books Financial Management Investing

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

Bcl3 Lewis Structure Molecular Geometry Polar Or Nonpolar Hybridization Bond Angle In 2022 Molecular Geometry Molecular Vsepr Theory

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Discounted Dividend Model Ddm Dividend Value Investing Financial Management

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula